Welcome to the $1 trillion club, Nvidia.

Nvidia’s stock is up more than 6% today, pushing its shares past $413 in the wake of a widely-praised earnings report.

Given that the stock market has battered tech stocks in recent quarters, how is Nvidia breaking away from the pack? What can we learn from its rise?

The club of trillion-dollar companies, measured by market capitalization, is so small that even Meta doesn’t make the cut today. Tesla is only 63% of the way there and Salesforce is not even worth a quarter of the required value it needs to join. To see Nvidia reach a market value of more than $1,000,000,000,000 is therefore a massive endorsement not only of its trailing operating results, but also its anticipated future. Investors expect a lot from Nvidia.

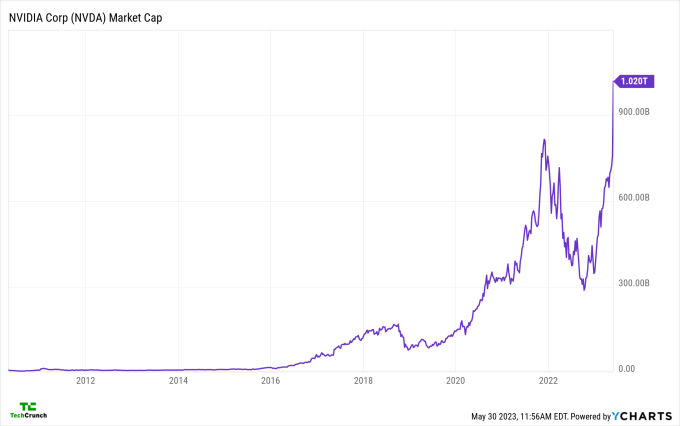

The following chart shows its ascent:

Image Credits: Ycharts

To get our minds around what’s going on, let’s go through the company’s latest earnings report, consider what it is forecasting, and discuss how investors and analysts missed the mark with their own expectations.

A look back and ahead

Nvidia is not an enterprise software company, so when we look at its results, we do not see what SaaS companies tend to produce: consistent revenue growth coupled with incremental profitability gains.

Instead, in the first quarter of fiscal 2024 ended April 30, Nvidia posted the following:

Welcome to the trillion-dollar club, Nvidia by Alex Wilhelm originally published on TechCrunch

from TechCrunch https://ift.tt/WCMLmpd

Comments

Post a Comment