It’s demo day season. This morning marked the kickoff of VC firm 500 Global’s Fall 2022 Demo Day, which saw over a dozen startups give their best pitches to prospective investors — and customers. Participants ran the gamut from fintech and sustainability to edtech and developer tools, and several stood out from the rest of the pack.

The event comes just weeks after Y Combinator had its bi-annual Demo Day, its first since moving operations back to in-person. 500 Global, formerly branded under 500 Startups, has an accelerator that competes with YC. Both outfits look to back early-stage founders with money and advice in exchange for equity. YC has backed over 3,500 founders, while 500 Global has backed more than 2,800 founders, according to each institution’s websites. Unlike YC, 500 Global has geographic-specific accelerator programs, similar to Techstars, with focus on areas like Aichi, Japan, Cambodia, and Alberta, Canada.

That said, today’s debut from 500 Global is from its first and flagship program, hailing back from 2010 and, fittingly, including companies from all around the globe. All companies go through a four-month program but start at different times, thanks to 500 Global’s somewhat new rolling admissions strategy. Let’s dig into some of the moonshots of the batch and end with some notes from Clayton Bryan, partner and head of 500 Global’s Accelerator Fund.

The moonshots

For example, there’s Taiwan-based Rosetta.ai, an ecommerce startup tapping AI to let customers search for products — particularly apparel and cosmetic — through specific attributes. Rosetta’s AI algorithm “sees” which attributes (e.g., sleeveless, ruffled, microbeads) a shopper might want as they browse an online store and builds a “preference profile” for them, which merchants can use to cross-sell or set up promotions that trigger if it seems likely the shopper will abandon their cart.

Image Credits: Rosetta.ai

It’s early days for Rosetta. But the company, which was founded in 2016, has raised $2.4 million in capital to date and claims to have customers including Shu Uemura, in which L’Oréal owns a majority stake. The trick will be continuing to win customers over rivals like Lily AI, which similarly attempts to match customers with products using attributes and AI models.

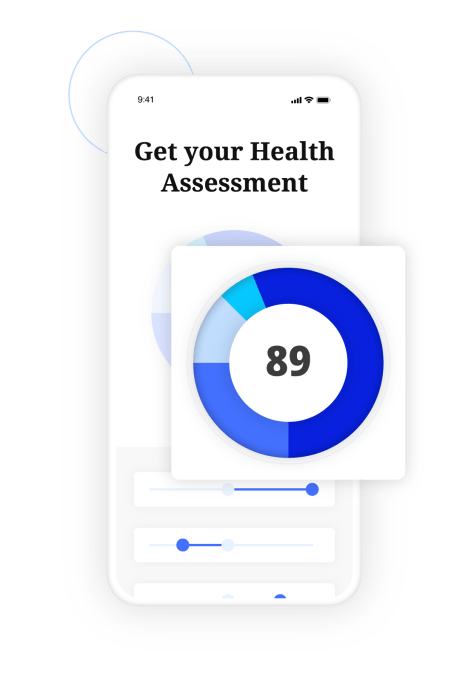

Elsewhere on Demo Day, Lydia.ai walked through its health assessment service for insurance carriers. Designed to do away with lengthy medical exams and forms, Lydia has insurance plan applicants answer a few questions about their health — e.g., whether they have a chronic illness, have recently been hospitalization and so on — via their smartphones. The platform then generates an abstracted health score supposedly devoid of sensitive medical details, which insurers can use for risk management and underwriting.

Image Credits: Lydia.ai

Lydia isn’t the first to attempt this. Health tech startup Fedo also algorithmically generates health scores, quantifying a person’s risk for diseases and their propensity to claim. The opaqueness of Lydia’s approach also raises questions, like whether its algorithms account for demographic differences and historic biases in health care. But if the startup remains true to its mission — insuring the next billion people — it could be one to watch, particularly given the capital (~$13 million) already behind it.

One of the more unique Demo Say startups that presented was BetaStore, a supplier for the “informal” retail outlets common in Africa. Informal retailers are unlicensed and unregistered retailers that don’t report to tax agencies, typically operating out of open markets and shops. BetaStore serves as a goods marketplace for informal retailers, providing access to staples such as dish soap, laundry detergent and all-purpose cleaner at wholesale prices and delivering them to the retailers (within 48 hours).

Image Credits: BetaStore

BetaStore customers can order products via chat, text message or WhatsApp. On the backend, the platform provides sales analytics to manufacturers, which BetaStore notes can be leveraged to make “data-driven” decisions to scale up shipments.

BetaStore appears to be off to a strong start. Founded in 2020, the Nigeria-based startup claims to have distributed over 140,000 goods to retail customers in Nigeria, Ivory Coast and Senegal and fielded over 20,000 orders. Recently, BetaStore began offering financing to retailers and plans to launch a buy now, pay later product in the coming months.

One year after the rebrand

Minutes after Demo Day ended, Bryan spoke to TechCrunch about 500 Global and how it’s growing within an increasingly volatile (and competitive) market.

“It’s been kind of gloomy, but we’ve told our companies time and time again that the silver lining is that 2021 was a phenomenal year for venture funds raising financing,” he said, fitting into the news that U.S. based investors are sitting on $290 billion in dry powder right now. The accelerator’s top advice was to start fundraising earlier, ready the company more before going out to the market, and stay smart on managing expenses. His advice these days is that startups should be preparing for at least 18 months of runway.

It has been almost a year since 500 Global rebranded from 500 startups, a move that Bryan said was meant to reposition the institution as less of an accelerator, and more of a venture firm. Its more than semantics; former batch participants have come back to 500 for follow-on funding, during their Series A but up till their series D.

“Historically, we haven’t had any any optionality, but now we’re going multi-strategy and we’re working on later stage funds,” he said. “We have the demand with our founder community, we have a demand even within our partner community that they want to have access to more de-risked companies.”

He added: “We’re very proud of our accelerator. It is a key vantage…but now it’s helped unlock other opportunities for us as a firm that we’re exploring with a lot of enthusiasm.”

As for if 500 will change its investment cadence, check size or focus – similar to YC as it prepared for a downturn – Bryan said there’s more to come.

“We’re not immune to the the changes that are happening in our ecosystem, we’re aware of what other funds are doing and other programs are doing,” he said. “Our program has been operating strongly for the last 10 plus years. But at the same time, we can’t rest on our laurels, and we’ve got to make sure that we have compelling deal terms.”

The biggest moonshots from 500 Global’s latest Demo Day by Kyle Wiggers originally published on TechCrunch

from TechCrunch https://ift.tt/AFHQcL1

Comments

Post a Comment